2019 fresh start tax program

Its designed to reduce fees and penalties for tax bills. As explained above the Fresh Start program also allows taxpayers to avoid tax liens by setting the amount owed at 10000 before the IRS can file a Notice of Federal Tax Lien against them.

Do S And Don Ts When Requesting Irs Penalty Abatement For Failure To File Or Pay Penalties Jackson Hewitt

Fresh Start Academy is geared towards everyday Business Development Professional.

. The regular IRS payment. The IRS Fresh Start initiative was created to make it easier and more accessible for people to repay or settle their tax debt. Raising the dollar amount.

This program provides taxpayers a form of relief by entering into a repayment program that can last up to six years. The IRS Fresh Start Installment plan is one of two payment plans that the IRS offers for tax debt. - Learn about the IRS Fresh Start Initiative Helping individuals and small business taxpayers get a Fresh Start with their tax liabilities including changes to Collection policy for.

While you can pay off your tax debt through full repayment to have your tax lien. The IRS Fresh Start Program allows taxpayers to pay off their tax debts affordably over six years. By giving us a call at 888-545-6007 you can speak to a Senior Tax Consultant at no cost and no obligation to discuss your tax situation and understand your options.

The IRS Fresh Start Program is a program that the IRS offers to taxpayers that have a tax debt. Now the standard amount you must owe to risk facing a tax lien is 10000 an increase from the previous amount. The Fresh Start Initiative changed the process of federal tax liens.

Based on their current income and the value of their liquid assets taxpayers. However taxpayers should file any delinquent 2018 return and their 2019 return on or before July 15 2020. The purpose of the IRS Fresh Start Program is to make it simple for people to.

Taxpayers make monthly payments towards their tax. There are three repayment options that this program covers. The IRS Fresh Start Installment plan is one of two payment plans that the IRS offers for tax debt.

A Tax Lien Withdrawal is technically considered a third tier of the Fresh Start Program. New OIC Applications The IRS reminds people facing a liability. What Is the IRS Fresh Start Program.

The IRS Fresh Start Program provides taxpayers with more flexible repayment terms and initiatives that may decrease or eliminate their tax debt without imposing penalties. Taxes often seem overwhelming and over-complicated. Read further to learn more about.

The IRS Fresh Start Relief Program was designed to give taxpayers laden with first-time tax debt a second chance to do things right and it included. Fresh Start is not a program but rather a series of changes that the IRS has made to the tax. This program is known as the IRS Fresh Start Program which aims to help ease the burden of taxpayers who havent paid their dues for several years.

A Tax Lien Withdrawal is technically considered a third tier of the Fresh Start. The Fresh Start Program is a program that has a number of tax relief options that can be used to help taxpayers reduce pay down and pay off. Our Industry-leading software is designed to allow Tax Preparers to start their business Today.

Tacoma Wa Irs Income Tax Relief Advocates Debt Forgiveness Freshstart Program

Do I Qualify For The Irs Fresh Start Program

Fresh Start Tax Relief Reviews Bestcompany Com

Irs Back Tax Forgiveness Fresh Start Program Youtube

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

Irs Fresh Start Program How Does It Work Infographic

2020 Guide To The Irs Fresh Start Initiative Best Tax Forgiveness Program Forget Tax Debt

Ohio And Irs Tax Relief Programs Ohio Tax Lawyer

Irs Fresh Start Program Tax Relief Initiative Information

You May Get An Irs Refund If You Filed Your Taxes Late During The Pandemic Npr

Why Does Msn Continue To Deliver Spam From Email Addresses I Ve Microsoft Community

Irs Fresh Start Program Guide With 2021 Updates Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Irs Fresh Start Program Tax Debt Relief Initiative Guide

![]()

What S The Irs Fresh Start Program The New Initiative Guide Video

Our Video Courses Landmark Tax Group

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

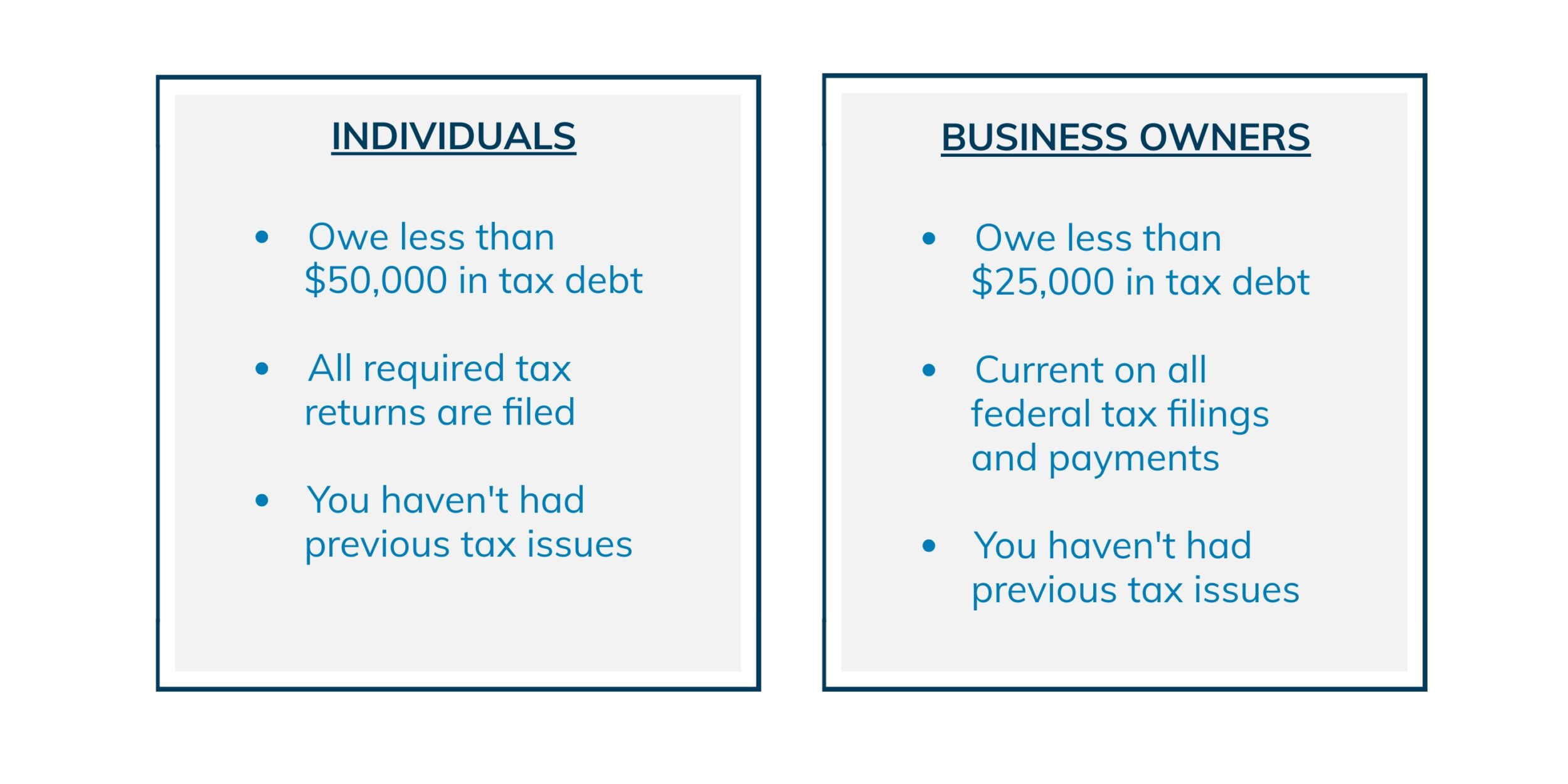

Who Qualifies For The Fresh Start Tax Program